Financial planning and analysis (FP&A) is an integral part of any successful business. This is because it plays a crucial role in strategic decision-making and helps organisations navigate the complexities of the financial landscape.

Gone are the days when financial planning was limited to budgeting and forecasting.

FP&A has evolved to encompass a wide range of activities that are essential for driving growth and profitability. From analysing financial data to providing valuable insights, FP&A professionals are the backbone of strategic decision-making within organisations.

What is FP&A?

Financial planning and analysis (FP&A) is a corporate function that involves a rigorous process of gathering, scrutinising, and interpreting financial data to understand a company's financial health.

The Role of Financial Planning and Analysis

FP&A goes beyond the traditional scope of financial analysis. It's an expansive role that includes:

FP&A goes beyond the traditional scope of financial analysis. It's an expansive role that includes:

Forecasting: FP&A experts look ahead, predicting future financial trends and outcomes based on historical data, market analysis, and economic indicators.

Budgeting: They are instrumental in planning how resources are allocated, ensuring that every dollar spent is an investment towards the company's strategic objectives.

Strategic planning: FP&A is the linchpin in formulating long-term business strategies. By analysing financial data, FP&A professionals can identify opportunities for growth, efficiency improvements, and risk mitigation.

What Does Financial Planning and Analysis Do?

Performance analysis: FP&A goes beyond basic number-crunching to conduct in-depth reviews of financial statements, operational metrics, and market trends, offering a comprehensive look at a company's historical and current performance.

Trend identification: It plays a pivotal role in detecting financial patterns and market signals, empowering businesses to anticipate and prepare for future challenges and opportunities.

Strategic recommendations: FP&A experts synthesise their findings to advise on actionable strategies that can enhance financial outcomes and drive business growth.

By interpreting the narrative that financial data tells, FP&A provides critical insights that inform strategic planning, resource allocation, and overall corporate decision-making, ensuring a company can navigate its financial path with foresight and agility.

What is Corporate Financial Planning and Analysis?

Corporate FP&A is the analytical powerhouse of a company's finance division, dedicated to high-level analysis and strategic planning. It's the process of taking the company's financial pulse - meticulously analysing every heartbeat of cash flow and financial activity - to map out a strategic path to success.

This specialised team collaborates closely with top-tier management to craft financial models, engage in competitive analysis, and generate forecasts that shape the company's strategic initiatives.

The Role of FP&A in Corporate Strategy

FP&A teams are indispensable allies to key decision-makers, including the CFO, CEO, and Board of Directors. They are the providers of financial insights that fuel strategic thinking and decision-making.

Here's a closer look at the pivotal roles they play:

Cash flow management: One of the quintessential functions of FP&A is overseeing the corporation's cash flow. The FP&A team equips the CFO with the insights needed to ensure the company's financial fluidity, enabling it to meet its current obligations and invest in future growth. By keeping a vigilant eye on cash flow, FP&A experts can pinpoint potential financial risks and opportunities, thus empowering the CFO with the knowledge to make strategic, data-driven decisions.

Quantitative and qualitative analysis: FP&A professionals are not just number crunchers; they are analytical thinkers who use both quantitative and qualitative methods to gauge the company's trajectory. They assess the company's performance, benchmarking it against past data and industry standards, to provide a comprehensive view of where the company stands and where it could go.

Financial modelling and forecasting: Through advanced financial modelling and forecasting techniques, FP&A teams lay out the financial implications of various business scenarios. This predictive power allows companies to brace for future challenges and proactively adapt their strategies to mitigate potential risks.

FP&A's contribution to an organisation is invaluable.

By interpreting complex financial data, these professionals provide a financial lens through which the company can view its operational effectiveness and strategic opportunities.

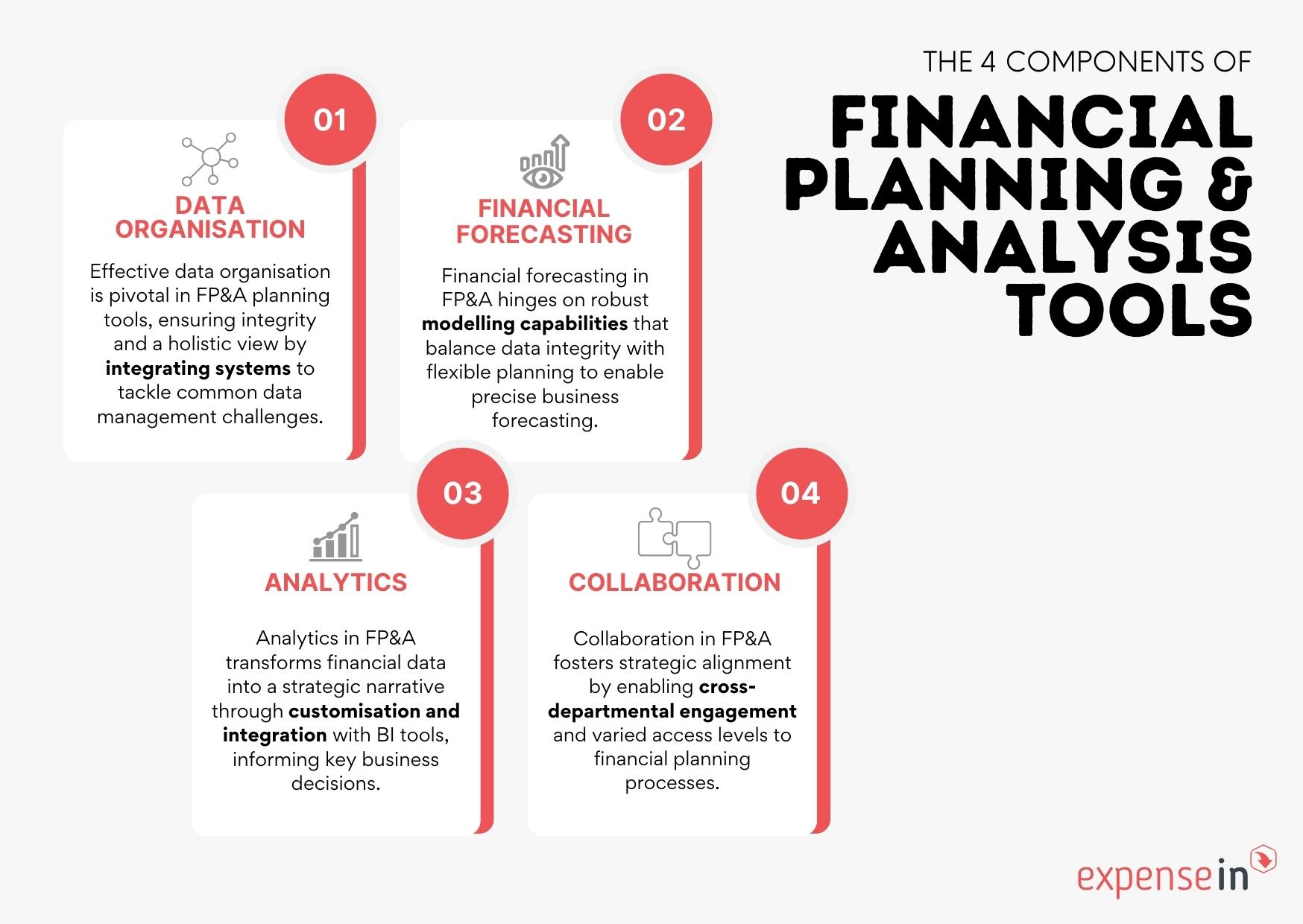

The 4 Components of Financial Planning and Analysis Planning Tools

FP&A planning tools stand on four fundamental components that are essential for any organisation seeking to enhance its financial operations. These are the backbone of effective FP&A and are critical in the selection process of a planning tool.

FP&A planning tools stand on four fundamental components that are essential for any organisation seeking to enhance its financial operations. These are the backbone of effective FP&A and are critical in the selection process of a planning tool.

Let's delve into each of these components:

1. Data Organisation: The Foundation of FP&A

Data organisation is the first and foremost component of FP&A planning tools. In the context of what is FP&A, it's about how these tools handle vast amounts of data from various sources.

Effective data organisation is crucial because:

It addresses the pain points of data preparation, cleaning, and consolidation, which are common challenges for FP&A professionals.

The integrity of the entire FP&A tool is compromised if data is flawed, leading to potential inaccuracies in financial analysis and reporting.

A robust FP&A planning tool should integrate seamlessly with at least three corporate systems, such as ERP, CRM, and HRIS, to ensure comprehensive data management.

This integration allows for a holistic view of the financial and operational aspects of the business, which is at the heart of what corporate financial planning and analysis is all about.

2. Financial Forecasting: The Art of Prediction

The second component, financial forecasting, is where the strategic aspect of financial planning and analysis comes into play. This involves:

Developing a data model that supports various dimensions for planning.

Utilising a powerful calculation engine for complex financial scenarios.

Balancing between structured data integrity and the flexibility of modelling.

The capability to build robust financial models is what distinguishes a good FP&A tool from a great one. It's about understanding what financial planning and analysis does - enabling businesses to forecast and plan with precision and agility.

3. Analytics: The Lens into Financial Health

Analytics, the third component, provides visibility into the company's financial performance. This is where FP&A translates into actionable insights for stakeholders.

An FP&A tool should offer:

Integration with presentation and BI tools for seamless reporting.

Customisation options for reports to meet the unique needs of the business.

A variety of visual and formatting options to convey financial data effectively.

This component is about transforming data into a narrative that informs strategic decisions, reflecting the essence of what is corporate financial planning and analysis.

4. Collaboration: The Glue of Cross-Functional Integration

Finally, collaboration forms the fourth component, emphasising the role of FP&A as a bridge between finance and operations. This involves:

Enabling multiple departments to engage in the financial planning process.

Providing a platform for threaded discussions, notes, and commentary on financial reports.

Offering custom views and data access levels to facilitate company-wide collaboration.

This component ensures that the FP&A function is not just a siloed entity but a central hub that fosters strategic alignment across the company.

Integrating Strategy with xP&A in Financial Planning and Analysis

The landscape of financial planning and analysis is transforming, adapting to the complex, interconnected nature of modern business.

This evolution has given rise to a new, integrated approach known as extended planning and analysis (xP&A), which is reshaping how organisations strategise and collaborate.

What is Extended Planning and Analysis (xP&A)?

Extended Planning and Analysis, or xP&A, is an advanced approach to financial planning and analysis that brings together all parts of a business to plan and analyse financial outcomes.

Unlike traditional FP&A, which often focuses on the finance department's perspective, xP&A involves every department to ensure a comprehensive financial strategy.

In short, xP&A is about creating a unified financial plan that takes into account the insights and data from every corner of the company. This means that instead of each department planning in isolation, they all contribute to a shared financial vision.

Example of xP&A at Work

Let's consider a technology company that is planning its budget for the next year. With xP&A:

The product development team provides estimates for research and development costs for new projects.

The sales department forecasts revenue based on market trends and sales channels.

The operations team assesses the costs of manufacturing and logistics.

The HR department projects future staffing needs and associated costs.

All this information is then integrated into a comprehensive financial plan. This plan is not just about numbers; it's a roadmap that guides the company through financial decisions and investments, ensuring that every department's actions are aligned with the company's financial goals.

By adopting xP&A, the company can make informed decisions that consider the impact on all areas of the business, leading to more effective strategies and better financial health.

Basic Steps in the Financial Planning and Analysis Process

The FP&A process involves several key steps that are essential for effective financial planning and analysis. These steps include:

The FP&A process involves several key steps that are essential for effective financial planning and analysis. These steps include:

Step 1: Collect and Integrate Financial Data

Start by gathering financial data from various departments such as sales, operations, and HR.

This includes historical financial statements, budgets, forecasts, and any other relevant financial information.

Pro Tip: Implement an FP&A software solution that can pull data from different systems (like ERP, CRM, etc.) to avoid manual data entry. This not only saves time but also reduces the risk of errors.

Step 2: Conduct Financial Forecasting

Use the collected data to predict future financial outcomes.

This involves analysing trends, understanding cost drivers, and considering external factors like market conditions.

Pro Tip: Don’t rely on a single forecasting model. Use a combination of methods like trend analysis, regression models, and machine learning algorithms to cross-validate your forecasts for greater accuracy.

Step 3: Create and Adjust Budgets

Develop a budget that aligns with your company’s strategic goals. This should detail how resources will be allocated to achieve these goals.

Remember, a budget is not set in stone; it should be reviewed and adjusted regularly.

Pro Tip: Engage with different department heads during the budgeting process to ensure that the budget is realistic and comprehensive. This also promotes buy-in and accountability across the organisation.

Step 4: Monitor and Analyse Performance

Regularly compare actual financial results with your budget and forecasts. Look for variances and try to understand the reasons behind them.

This will help you identify areas of the business that are performing well and those that need attention.

Pro Tip: Develop a dashboard that provides a snapshot of financial performance against key indicators. This can help you quickly spot trends and make data-driven decisions.

Step 5: Provide Strategic Business Insights

Translate your findings into actionable insights for business leaders.

This means not just reporting the numbers, but also providing analysis and recommendations for improving financial performance.

Pro Tip: Learn to communicate complex financial information in a clear and concise way that non-financial stakeholders can understand. Storytelling with data can be a powerful tool to influence strategic decisions.

The Future of FP&A

As businesses face increasing challenges, the role of FP&A becomes even more critical. The need for smart FP&A tools and technologies is evident to navigate the complexities of the modern business landscape.

Real-time, data-driven insights are essential for informed decision-making. FP&A professionals need access to accurate and up-to-date financial information to provide valuable insights to decision-makers. By leveraging advanced analytics, artificial intelligence, and automation, companies can enhance their FP&A capabilities and gain a competitive edge.

In conclusion, mastering the art of financial planning and analysis is crucial for organisations to unlock the key to strategic decision-making. FP&A professionals play a transformative role in driving business growth and profitability. Through utilising their expertise and capabilities, businesses can more successfully navigate the difficulties of the financial landscape and achieve their strategic goals.

Want to revolutionise your financial planning and analysis process? Book a demo with ExpenseIn to see how an automated expense management solution can help.