Are hidden costs silently draining your company's finances?

Indirect spend, often overshadowed by more visible expenses, can be a stealthy culprit in undermining your business's financial health. From essential software subscriptions to the unnoticed office supplies, these costs, while vital for daily operations, can spiral out of control if left unchecked.

This article tackles the often-neglected world of indirect spend, offering insights and strategies to not just rein in these expenses, but to turn them into avenues for efficiency and business growth.

What is Indirect Spend?

Indirect spend refers to the expenses not directly linked to the production or primary services of a company. These are the costs essential for the smooth running of your business but don't directly contribute to the final product or service.

Examples of Indirect Spend

Software and subscriptions: This includes the various software platforms and subscription services your business uses. While they don't directly create your product, they're vital for operations like communication, project management, and customer relations.

Office supplies and equipment: Items such as desks, computers, and stationery fall under this category. They're necessary for a functional office environment but aren't part of your core product or service offering.

Employee development: Costs associated with training and professional development for your team are considered indirect spend. These investments contribute to a skilled and efficient workforce, which, in turn, supports the business's overall performance.

Facility operations: Expenses related to maintaining your business premises, such as utilities and cleaning services, are also indirect spends. They ensure a conducive work environment, which is crucial for productivity.

For finance professionals, understanding indirect spend is key to effective budget management. It's about recognising the role these expenses play in supporting the business infrastructure and finding ways to optimise them.

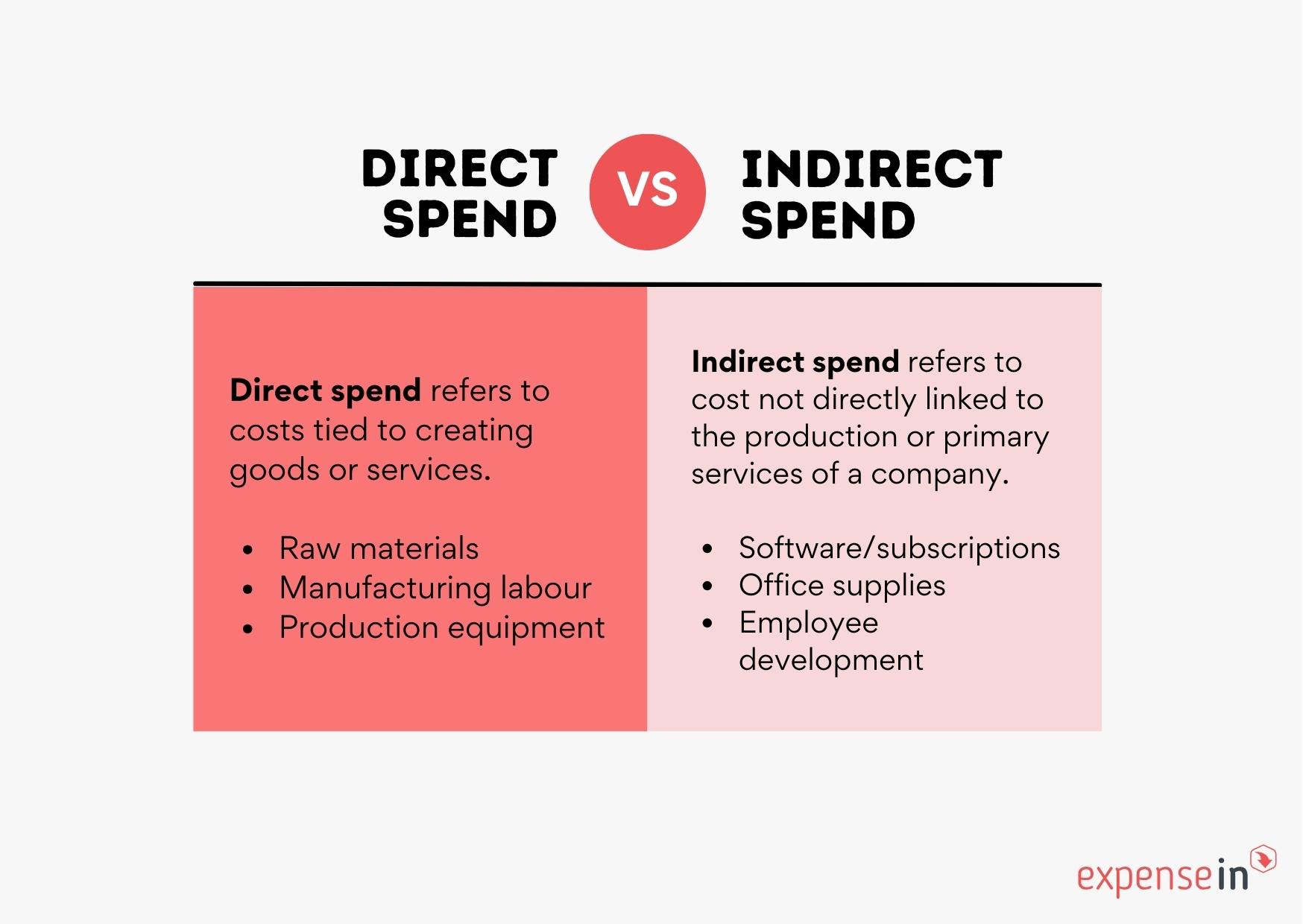

Direct vs Indirect Spend

Direct spend refers to the expenses directly associated with the production of goods or services. This category includes costs like:

Direct spend refers to the expenses directly associated with the production of goods or services. This category includes costs like:

Raw materials

Manufacturing labour

Production equipment

It's directly linked to the company's core activities, significantly influencing the cost of goods sold (COGS), pricing strategies, and ultimately, the revenue generation. In essence, direct spend is at the heart of the product or service creation process.

Indirect spend, as we covered in the previous section, encompasses the costs that support the overall operations of a business but are not directly tied to the production process.

While these costs might not be directly linked to the production of goods or services, they are vital for sustaining business infrastructure and efficiency.

What is the Difference Between Direct & Indirect Spend?

The primary difference between these two spending categories lies in their direct impact on the company's product or service output.

Direct spend is a direct contributor to what the company produces, affecting tangible aspects like production volume and quality.

Indirect spend, however, supports the broader operational aspects, ensuring that the business has the necessary resources and environment to operate effectively.

For professionals and finance managers, recognising the difference between direct and indirect spend is fundamental. It influences how:

Budgets are allocated

Costs are controlled

Financial strategies are developed

Balancing direct and indirect spend is not just about cost management; it's about strategic investment in both the production capabilities and the operational foundations of the company.

Effective Management of Indirect Spend

Understanding indirect spend, as previously discussed, is just the first step. The next crucial phase is managing these expenses effectively, which is vital for maintaining your business's financial health and operational efficiency.

Understanding indirect spend, as previously discussed, is just the first step. The next crucial phase is managing these expenses effectively, which is vital for maintaining your business's financial health and operational efficiency.

1. Centralise Your Indirect Spend

Centralising your indirect spend is a practical approach. This means gathering all your indirect costs, such as software subscriptions, office supplies, and facility operations, under one management umbrella.

Centralising helps you gain a clear overview of where your money is going, making it easier to spot opportunities for cost savings. It also simplifies the management process, making it more efficient and less prone to errors.

2. Build Strong Relationships with Suppliers

Another important aspect of managing indirect spend is building and maintaining strong relationships with suppliers.

Unlike direct spend, where the focus might be more on immediate costs and quantities, indirect spend requires a more strategic approach.

Good relationships with suppliers can lead to:

Better terms

Improved services

Access to innovative solutions that can benefit your business long-term

Regularly evaluating these relationships ensures they continue to align with your business goals and contribute positively to your operations.

3. Conduct Periodic Reviews of Your Indirect Spend

Regular monitoring of your indirect spend is also essential.

This involves ensuring that your spending aligns with your overall business budget and adjusting your strategies as necessary to stay aligned with your business goals and changing needs.

Periodic reviews of your spending can help in identifying areas where adjustments are needed, ensuring that every pound spent is contributing to the smooth running and success of your business.

Challenges of Indirect Spend (& How to Overcome Them)

Indirect spend management, a crucial yet often overlooked aspect of business finance, presents unique challenges. While not directly tied to a company's primary operations, indirect spend significantly impacts cost savings and efficiency.

Indirect spend management, a crucial yet often overlooked aspect of business finance, presents unique challenges. While not directly tied to a company's primary operations, indirect spend significantly impacts cost savings and efficiency.

Key challenges include:

Lack of visibility and control: With numerous small transactions across various departments, indirect spend can be difficult to track and manage effectively.

Decentralised purchasing decisions: Different departments making independent purchasing decisions can lead to inconsistent pricing, duplicate orders, and inefficient supplier relationships.

Complex supplier management: Handling a wide range of suppliers for various services and goods can be challenging, often resulting in missed opportunities for consolidated purchasing or better negotiation terms.

Overcoming the Challenges with Expense Management Software

Expense management systems like ExpenseIn offers targeted solutions to the common challenges in managing indirect spend.

Here's how each feature specifically addresses these challenges:

Enhanced visibility and control: ExpenseIn's real-time receipt scanning and comprehensive reporting provide a clear view of all expenses. This feature helps in tracking numerous small transactions across departments, effectively addressing the challenge of lack of visibility and control in indirect spend.

Streamlined expense reporting and approval process: The software's efficient expense claims process, including automatic mileage calculations and quick receipt scanning, standardises and simplifies the reporting and approval of expenses. This approach helps overcome the challenge of decentralised purchasing decisions, reducing inconsistent pricing and duplicate orders.

Simplified and efficient supplier management: With powerful real-time reporting and data analysis, ExpenseIn aids in better understanding and managing relationships with various suppliers. This feature addresses the challenge of complex supplier management, facilitating opportunities for consolidated purchasing and improved negotiation terms.

Efficient invoice management: ExpenseIn’s invoice approval module simplifies the process of managing supplier invoices with features like real-time scanning for automatic data capture, customizable approval workflows, and direct posting to accounting software. It supports pre-approved purchase requests to control employee spending and provides smart reporting for real-time financial oversight.

Policy compliance and fraud prevention: Automated policy enforcement and alerts for non-compliant transactions ensure that all expenses comply with company policies. This feature directly tackles the challenge of maintaining control over indirect spend and ensuring that expenses are legitimate and justified.

Integration with other business systems: ExpenseIn's ability to integrate with other financial and business platforms provides a more comprehensive view of the company's financial health. This integration aids in better overall management of indirect spend.

Legal and financial compliance: Ensuring compliance with HMRC regulations is crucial for legal and financial accountability. This feature helps businesses avoid legal complications that can arise from improper employee expense management.

How to Reduce Indirect Spend: Strategies for Cost-Saving

Effectively managing and reducing indirect spend is vital for enhancing a company's financial health and operational efficiency.

Effectively managing and reducing indirect spend is vital for enhancing a company's financial health and operational efficiency.

Here's a comprehensive guide:

Step 1: Implement Enhanced Inventory Management Techniques

Proper inventory management is key to controlling indirect spend. This involves several critical practices:

Demand forecasting: Utilise advanced forecasting tools to accurately predict future product needs. Analyse historical sales data, market trends, and seasonal variations to ensure precise forecasting, which helps in maintaining optimal inventory levels and reducing costs associated with excess stock.

Inventory optimisation: Regularly adjust inventory levels to align with current demand. This process should include the identification and elimination of obsolete or slow-moving items and adopting just-in-time (JIT) inventory practices to minimise holding costs and improve cash flow.

Pro Tip: Leverage predictive analytics and AI-driven tools for more accurate demand forecasting. These technologies can analyse vast datasets, including market trends and consumer behaviour, providing deeper insights and more precise predictions than traditional methods.

Step 2: Leverage Technology for Optimising Indirect Spend

Incorporating the right technology is crucial in managing and reducing indirect spend:

Spend analytics tools: Implement these tools for a detailed view of all indirect spending. They assist in spotting spending trends, assessing supplier performance, and finding cost-saving opportunities, such as supplier consolidation or contract renegotiation.

E-procurement solutions: Streamline procurement processes with these solutions. They offer features like electronic purchase orders, automated approval workflows, and centralised purchasing, which enhance spend visibility and control.

Expense management software: Use features like mobile app access, receipt scanning, automated policy compliance, advanced approvals, real-time reporting, card reconciliation, and mileage recording to track and analyse expenses efficiently.

Invoice capture software: Enhance your indirect spend management with capabilities for invoice processing, which includes seamless integration with your accounting software, ensuring that all supplier expenses are accounted for and properly managed.

Pro Tip: Ensure that your chosen software solutions for spend analytics, e-procurement, and expense management can be integrated with each other. This compatibility is crucial for a seamless data flow, allowing you to have a unified view of your spending and enhancing decision-making and operational efficiency. The more interconnected your systems are, the more streamlined and effective your spend management becomes.

Step 3: Streamline Procurement Processes

Optimising procurement processes is crucial for effective indirect spend management:

Centralise purchasing: By centralising procurement, you gain better control over spending, enabling more effective negotiations and bulk purchasing advantages.

Ensure contract compliance: Regularly review contracts to ensure adherence to terms. Monitor for any deviations in price, delivery, and quality, addressing non-compliance promptly to avoid unnecessary costs.

Pro Tip: Implement a supplier performance management system. Regularly score your suppliers based on criteria like delivery time, quality, and cost. This approach not only ensures contract compliance but also helps in building stronger relationships with top-performing suppliers, potentially leading to better terms and cost savings.

Step 4: Regularly Review and Adjust Strategies

Maintaining control over indirect spend requires ongoing attention:

Conduct periodic assessments: Regularly evaluate your indirect spend management strategies, including the effectiveness of expense management software, to ensure they align with current market conditions and business needs.

Stay adaptable: Be prepared to adapt your strategies in response to new market conditions, emerging technologies, or operational changes. This flexibility can lead to more effective spend management and ongoing cost savings.

Pro Tip: Utilise advanced reporting and business intelligence tools to visualise spending trends and identify areas for improvement. Regularly scheduled reviews should be data-driven, leveraging these tools to make informed decisions and adapt strategies effectively.

Conclusion: Optimising Indirect Spend for Business Growth

In wrapping up, remember that mastering indirect spend isn't just about cutting costs - it's about unlocking the hidden potential within your business.

The strategies we've explored are more than guidelines; they're the keys to transforming a routine financial task into a strategic advantage. By embracing these approaches, you're not just managing numbers; you're sculpting the financial future of your business.

With the right focus and tools, indirect spend can shift from a silent budget eater to a catalyst for growth and efficiency. This isn't just financial management; it's a strategic move towards a more prosperous and sustainable business model.

Book a demo with ExpenseIn today and take the first step towards optimising your indirect spend for sustainable business growth.