Top 10 Business Expense Tracker Apps in 2026

Breakdown of the 10 best business expense tracker apps in 2025.

If you lead a finance team in the UK or Ireland, you probably know the drill:

Spreadsheets everywhere

Receipts missing

Budgets blown without warning

Employees waiting (and waiting) to be reimbursed

You’re not imagining it – expenses are now one of the most pressured finance operations, second only to payroll, according to a survey of 125 UK finance leaders.

In the same study, more than half of organisations said they plan to cut expenses this year, putting even more pressure on efficiency and control.

In the same study, more than half of organisations said they plan to cut expenses this year, putting even more pressure on efficiency and control.

For most finance leaders, the pain shows up in a few familiar ways:

Blind spots until month-end. 97% of UK finance leaders say they lack real-time visibility, and 95% report that fragmented, manual tools make robust spend control hard. Many teams even run different processes by region, multiplying the risk of surprises.

High admin burden and processing costs. The average manual expense report costs approximately £23.14, adjusted for inflation to put together, before you count the lost time and opportunity cost.

Employee dissatisfaction with out-of-pocket spend. Staff front business costs on personal cards, then wait to be reimbursed – hurting morale and creating extra work for finance.

Policy leakage and compliance risks. When checks happen after the purchase, unapproved spend slips through and policy breaches surface too late to fix.

Messy reconciliation with fragmented tools. 57% still use paper forms and 45% rely on spreadsheets, so statements, receipts, and approvals don’t line up – and close runs slower than it should.

The good news: a virtual expense card takes the pain out of the process.

It enforces limits as the payment happens, captures receipts instantly, and gives finance a live view of spending instead of relying on end-of-month catch-ups.

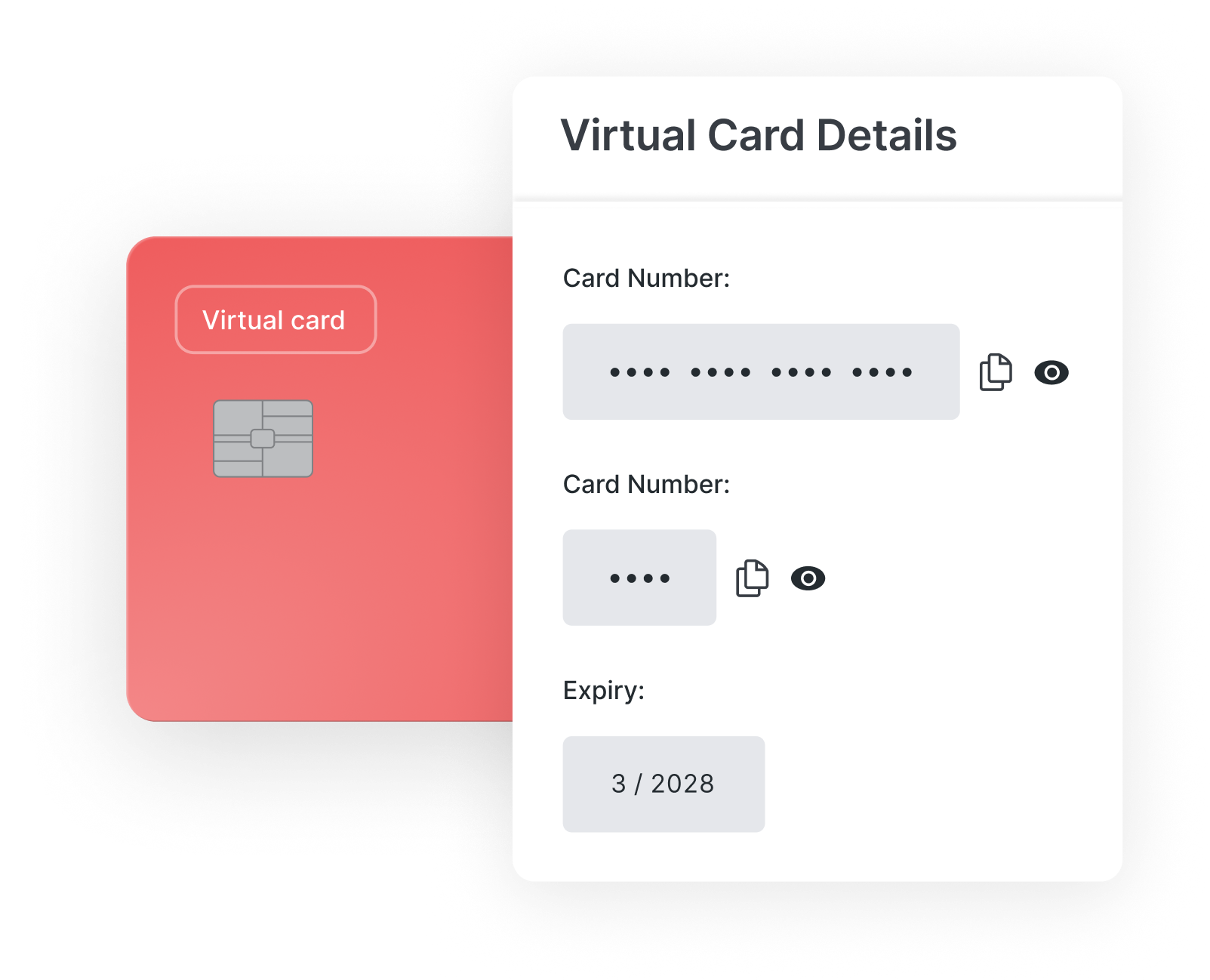

A virtual expense card is a digital payment card (16-digit number, expiry, CVV) issued for business spend – no plastic required.

Employees use it online, and you control how, where, and when it can be used. Think instant issuance, tighter controls, and better data, without waiting weeks for a physical card.

Instant issuance vs waiting for plastic. Create a card in seconds for a person, project, or even a single purchase.

Granular spend controls for compliance. Restrict spend by merchant category, date window, and per-transaction/daily limit.

Security by design with unique numbers. Easy deactivation and unique numbers (even single-use) shrink the fraud window.

Integration into expense management systems for automation. Purchases are automatically imported into your expense platform, creating draft expenses with receipt prompts.

No surprise, then, that adoption is accelerating: 37% of corporate travel buyers now use virtual payments in their programs, with most expecting usage to expand significantly over the next five years.

The difference becomes clear when you compare traditional expense reimbursements with a virtual expense card side by side:

5 Ways Virtual Expense Cards Solve the Biggest Finance Pains

5 Ways Virtual Expense Cards Solve the Biggest Finance PainsSo, what does this look like in practice?

These are the top five ways virtual business cards make life easier for finance (and employees too):

Every transaction appears in your dashboard as it happens.

That means you can step in before a budget goes off track – closing the 97% visibility gap reported by UK finance leaders.

Purchases auto-generate draft expenses, and employees get nudged to snap a receipt on the spot.

This already slashes the average £23.14 manual expense report processing cost.

Issue cards for travel, subscriptions, or projects so staff never have to fund the business on personal cards.

Finance sees spend in real time; employees see reimbursements disappear.

Program spend rules once (limits, categories, dates, etc.). Unapproved transactions don’t go through.

No detective work. No awkward manager conversations.

When card payments, expense receipts, approvals, and accounting sync live together in one tool, reconciliation becomes seamless, and finance finally has a clean, company-wide spend picture.

1. Map your process & set measurable goals

1. Map your process & set measurable goals Identify where time or control is being lost: approvals, policy enforcement, reimbursements, or reconciliation.

Turn those into measurable targets (e.g., “reduce claim cycle time from 9 days to 48 hours”).

Select a solution that connects payments, receipts, approvals, and accounting in one place.

Check for native integrations with your finance stack so you won’t be managing multiple disconnected tools.

Start small – for example, travel expenses, team budgets, or software subscriptions.

Roll out to a single department, gather feedback, refine the controls, then expand across the organisation.

Set default rules from day one:

Spend limits

Merchant categories

Date windows

Weekend restrictions

Receipt requirements

This ensures consistency without relying on manual enforcement later.

Provide clear guidance on how cards are issued, used, and approved.

Focus on practical “how-tos” and make policies transparent, so employees and managers know exactly what to expect.

Schedule regular reviews of transaction data and reports.

Use these to adjust limits, spot patterns, and track whether your initial goals (faster cycle times, fewer exceptions, stronger financial compliance) are being met.

Not all virtual corporate cards are created equal.

Before you commit, here are the questions every finance leader should ask to separate a true end-to-end solution from “just another card”:

Does it integrate with my entire workflow? Will purchases flow automatically into draft expenses, receipt capture, approvals, and accounting – or will my team still be stuck rekeying data and exporting spreadsheets?

How granular are the spend controls? Can I set per-transaction, daily, and monthly limits? Restrict by merchant category, geography, or even block weekend spend? Or are controls too basic to enforce policy in real time?

How fast can I issue and manage cards? Can I create or deactivate a card in seconds, including single-use numbers for one-off vendors, or am I waiting days for a bank to process changes?

Does it support mobile-first approvals and alerts? Will managers and employees get real-time notifications (e.g. for receipts, big transactions, or declines) on their phones, or will approvals still pile up in inboxes?

What reporting and audit trails will I get? Can I drill into spend by team, project, or vendor with attached receipts and approval history, or am I limited to generic statements?

How is security handled? Is the platform GDPR-compliant and independently certified, with bank-level encryption to keep data safe? Can I deactivate instantly if fraud is suspected?

What support will I have if something goes wrong? Will I have access to responsive, finance-focused support and account management, or just a generic help desk?

Because ExpenseIn’s virtual business expense card is built into the ExpenseIn expense tracking platform, you get:

Because ExpenseIn’s virtual business expense card is built into the ExpenseIn expense tracking platform, you get:

Instant receipt reminders

Draft-expense creation

Automatic syncing with your accounting software

Because it’s built into the ExpenseIn platform, everything runs in one system – no juggling between tools.

For UK & Ireland finance teams, it’s the simplest path from firefighting to foresight.

Quick Self-Test: Is It Time for Virtual Expense Cards?

Quick Self-Test: Is It Time for Virtual Expense Cards? Ask yourself:

Do you only find out about overspend at month-end (or later)?

Are you still chasing receipts and approvals after the fact?

Do employees have to pay out of pocket and wait for reimbursement?

Do policy breaches slip through because checks happen too late?

Does reconciliation or rekeying slow down your close?

More than one “yes”?

That’s a clear sign virtual expense cards could ease the pressure and give you better oversight.

Controlling expenses isn’t about being draconian – it’s about enabling smarter spending. Virtual expense cards give employees flexibility while giving finance real-time control.

The result? Fewer nasty surprises, tighter budgets, and an expense process people don’t dread.

If you want to see how this looks inside an integrated platform, explore how the ExpenseIn Card plugs directly into your existing workflows, and how quickly it can move your team from reactive firefighting to proactive financial control.