Your employees are already paying by phone. The only question is whether finance is seeing those transactions in real time or finding them later as “mystery spend” with missing expense receipts and no context.

This isn’t fringe behaviour anymore. In the UK, cash now accounts for less than 10% of all payments, meaning day-to-day spend is digital by default. In Ireland, 87.9% of point-of-sale card payments were contactless in the first half of 2025.

For finance teams, that shift creates a fork in the road. Digital wallets can either increase clean-up, chasing, and reconciliation work, or they can reduce expense reimbursements, speed up purchasing, and tighten control.

Why Digital Wallets Matter for Finance Teams in 2026

Digital wallets are already normal payment behaviour, and finance teams are feeling the knock-on effects in spend volume, employee expectations, and audit pressure.

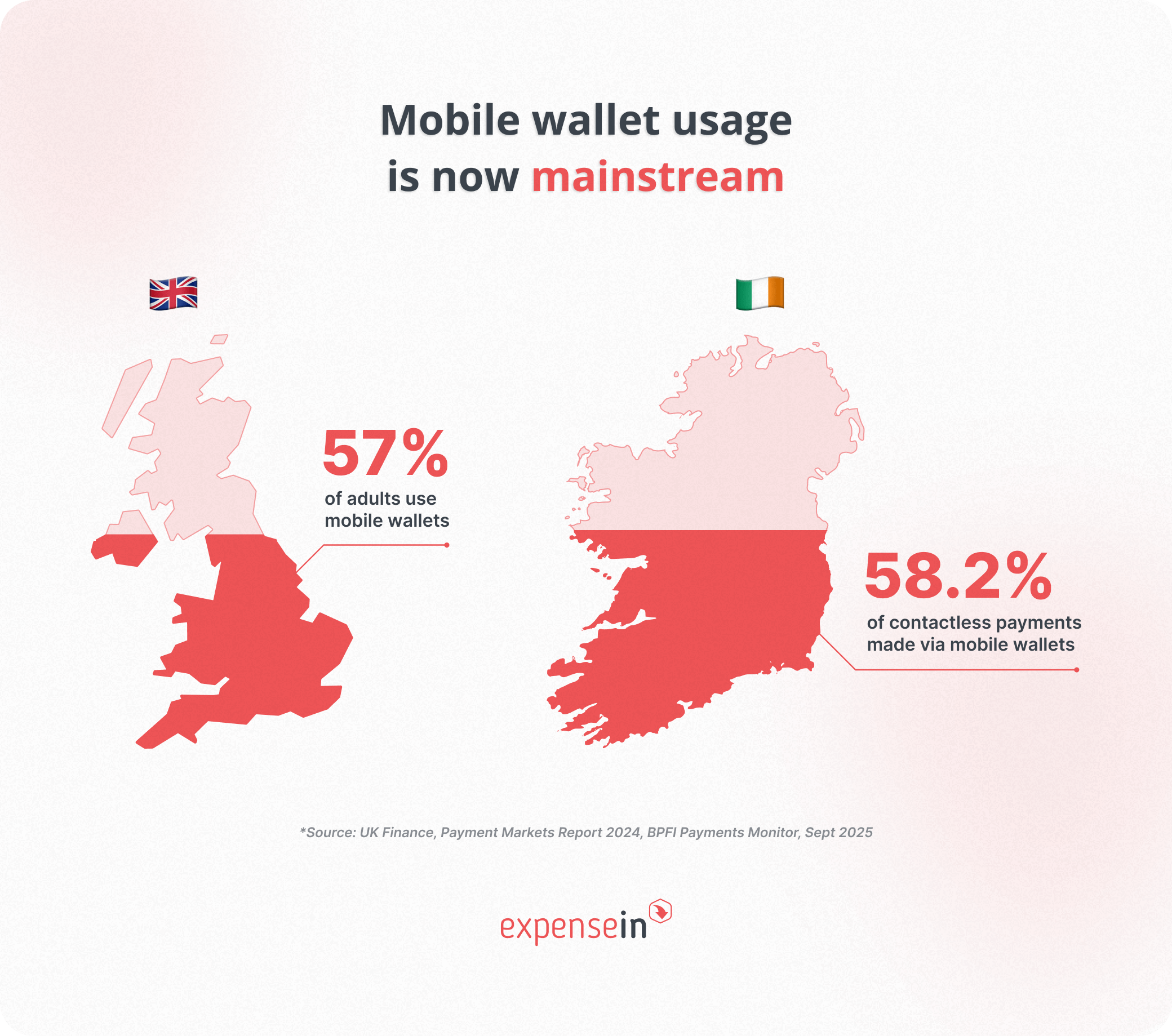

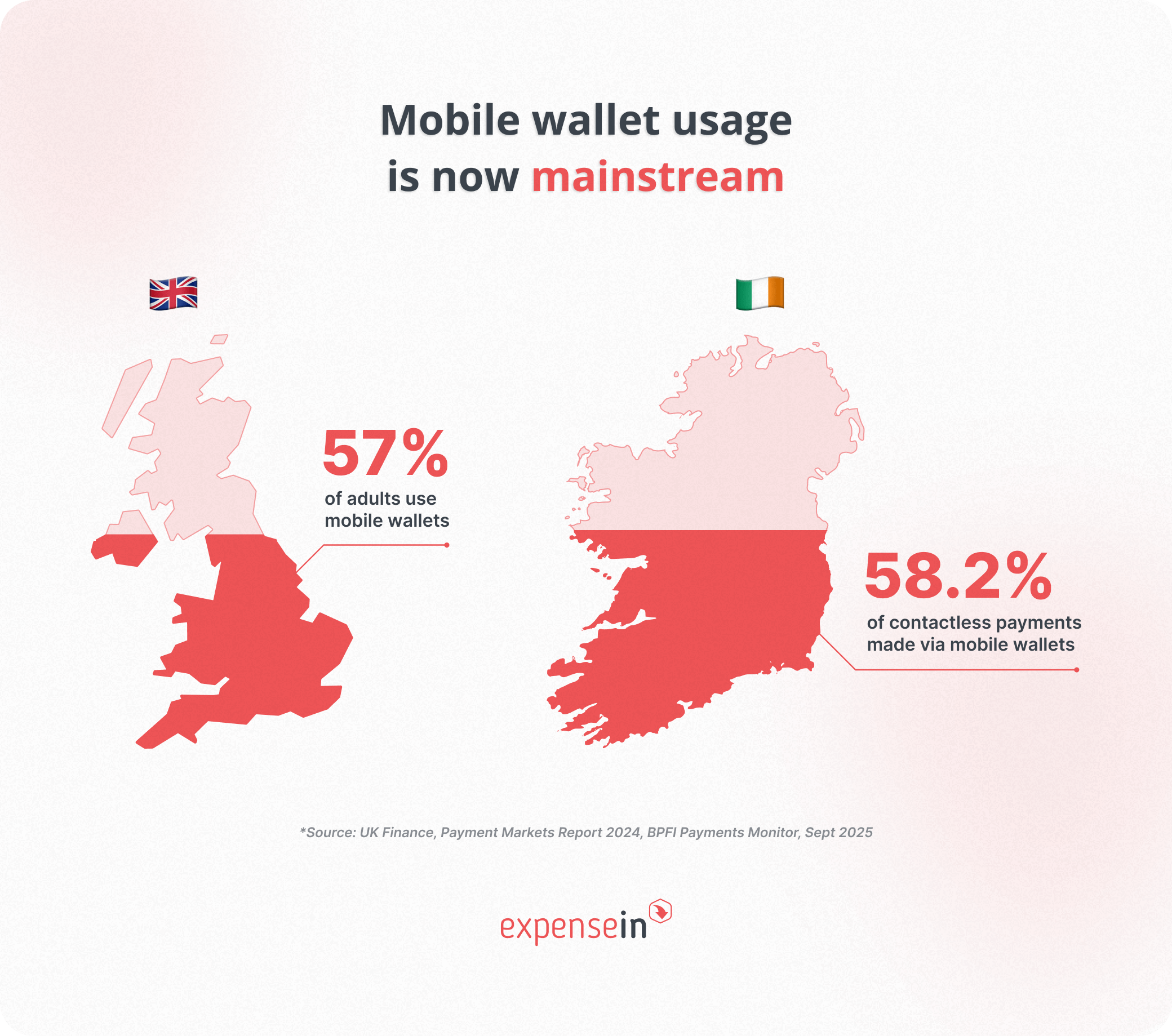

In the UK, 57% of adults now use mobile wallets, and there were 18.9 billion contactless card payments in 2024.

In Ireland, 58.2% of contactless payments were made using mobile wallets in H1 2025, with 893 million mobile wallet payments worth almost €17.9bn in the 12 months to June 2025.

That scale is exactly why wallets can be a win for finance, but only when wallet payments are properly connected to your controls and expense system.

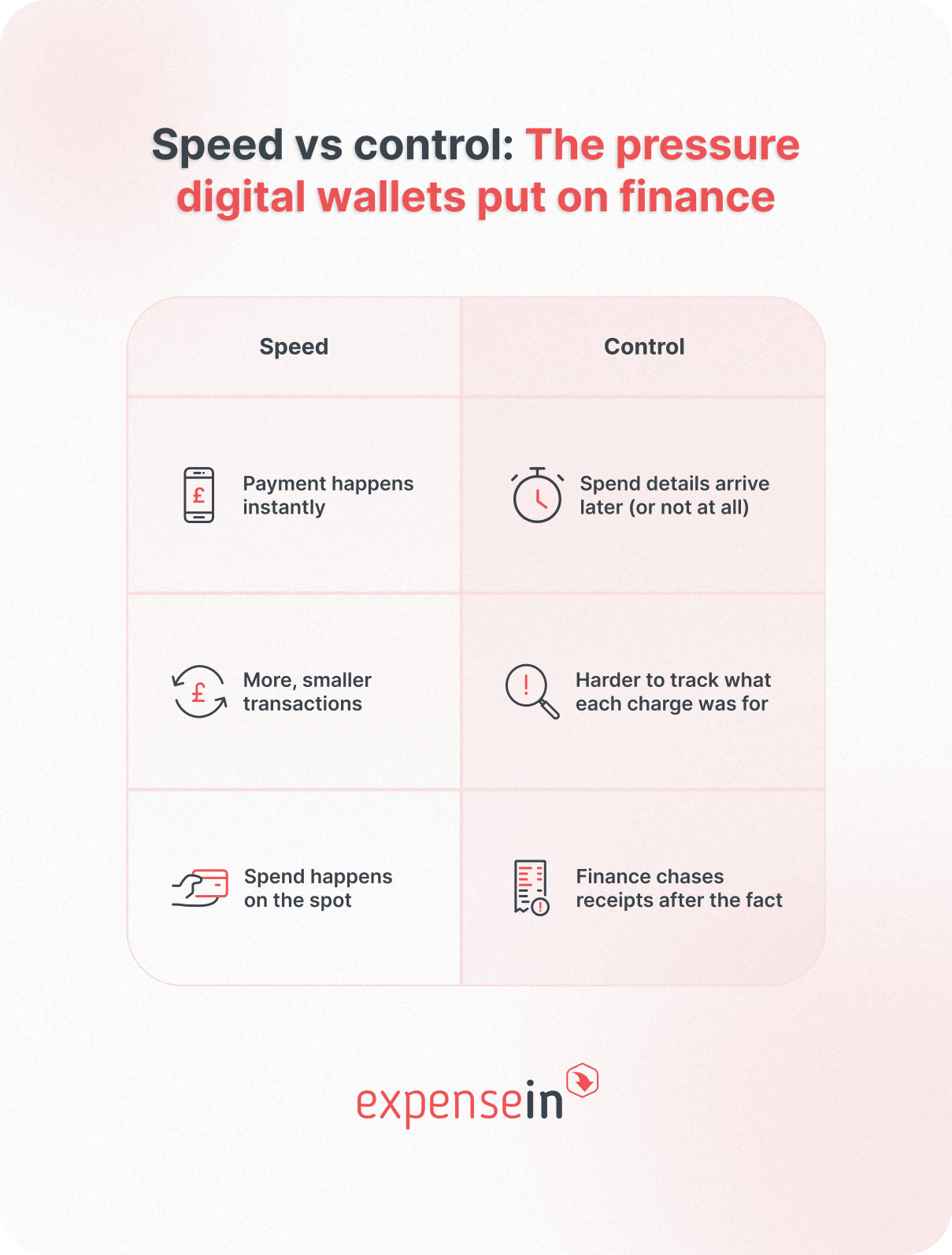

Speed vs Control: Where Finance Teams Feel the Pressure

Faster payments, without losing the audit trail

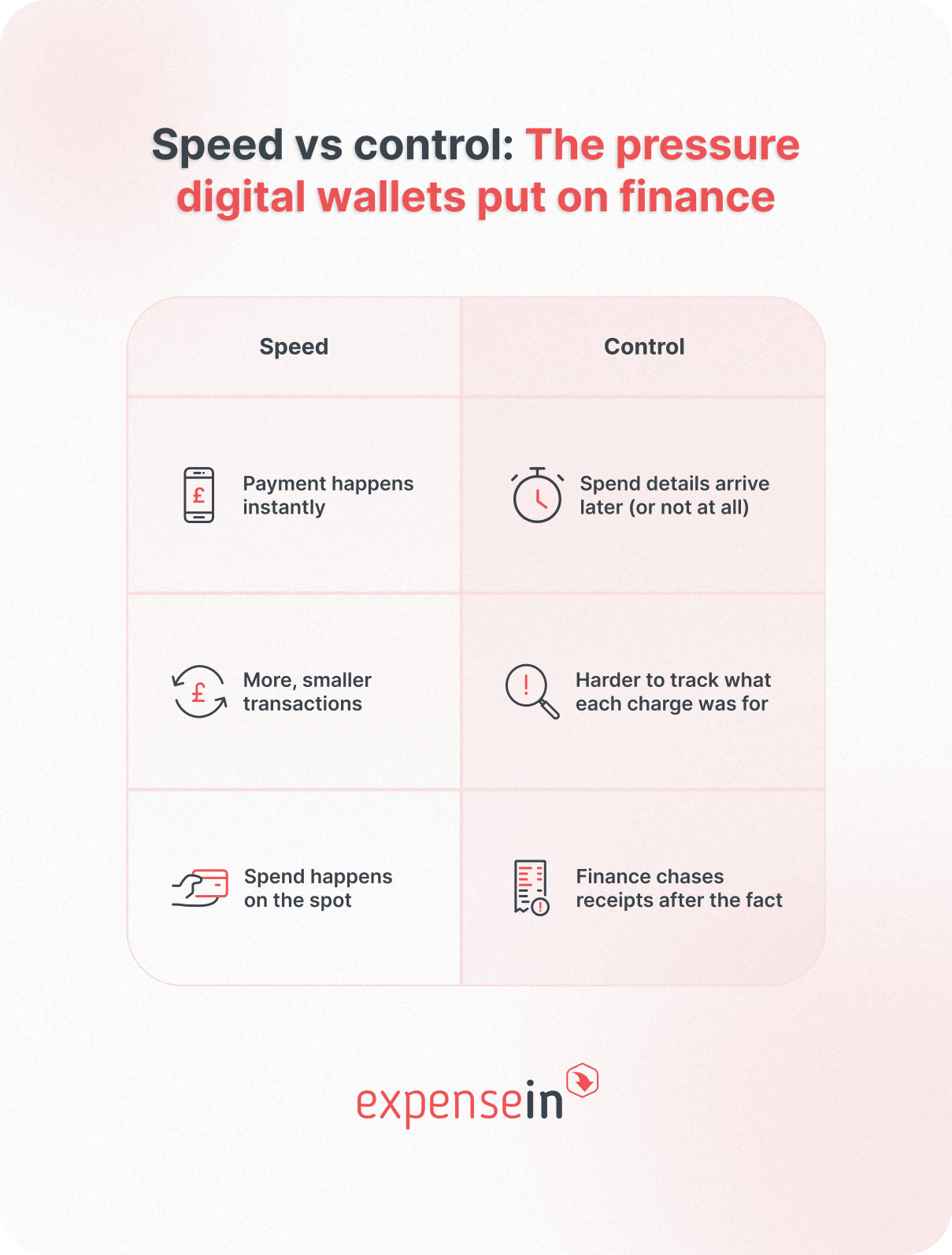

Mobile wallets make paying effortless: tap, done, move on. That’s great for employees.

For finance, the “after” still matters:

At today’s volumes, that breaks down quickly. In Ireland alone, people made 306 contactless payments per person in one year (around 1.6 billion contactless payments worth nearly €28.3bn).

The answer isn’t blocking wallets. It’s making sure each wallet transaction feeds directly into a system that:

Access to spend has changed

Work rarely aligns with expense card delivery timelines.

Waiting days for a physical card often pushes people toward personal spending and reimbursements, creating extra admin for finance.

With a virtual expense card added to a digital wallet, finance can grant spending access immediately and within defined limits.

Why volume breaks manual processes

It’s true that digital wallets can increase the number of small transactions, but volume alone doesn’t drive workload. Manual handling does.

When wallet spend is linked to the expense process:

Each transaction automatically creates a draft expense,

Merchant and amount details are captured in real time, and

Employees are prompted to submit receipts while the purchase is still fresh.

Instead of piecing together charges weeks later, finance reviews complete, policy-checked expenses as they happen.

How Secure is Paying with a Digital Wallet for Business?

When finance teams look at enabling a digital wallet for corporate cards, the first question is usually simple: Is this safe for company money?

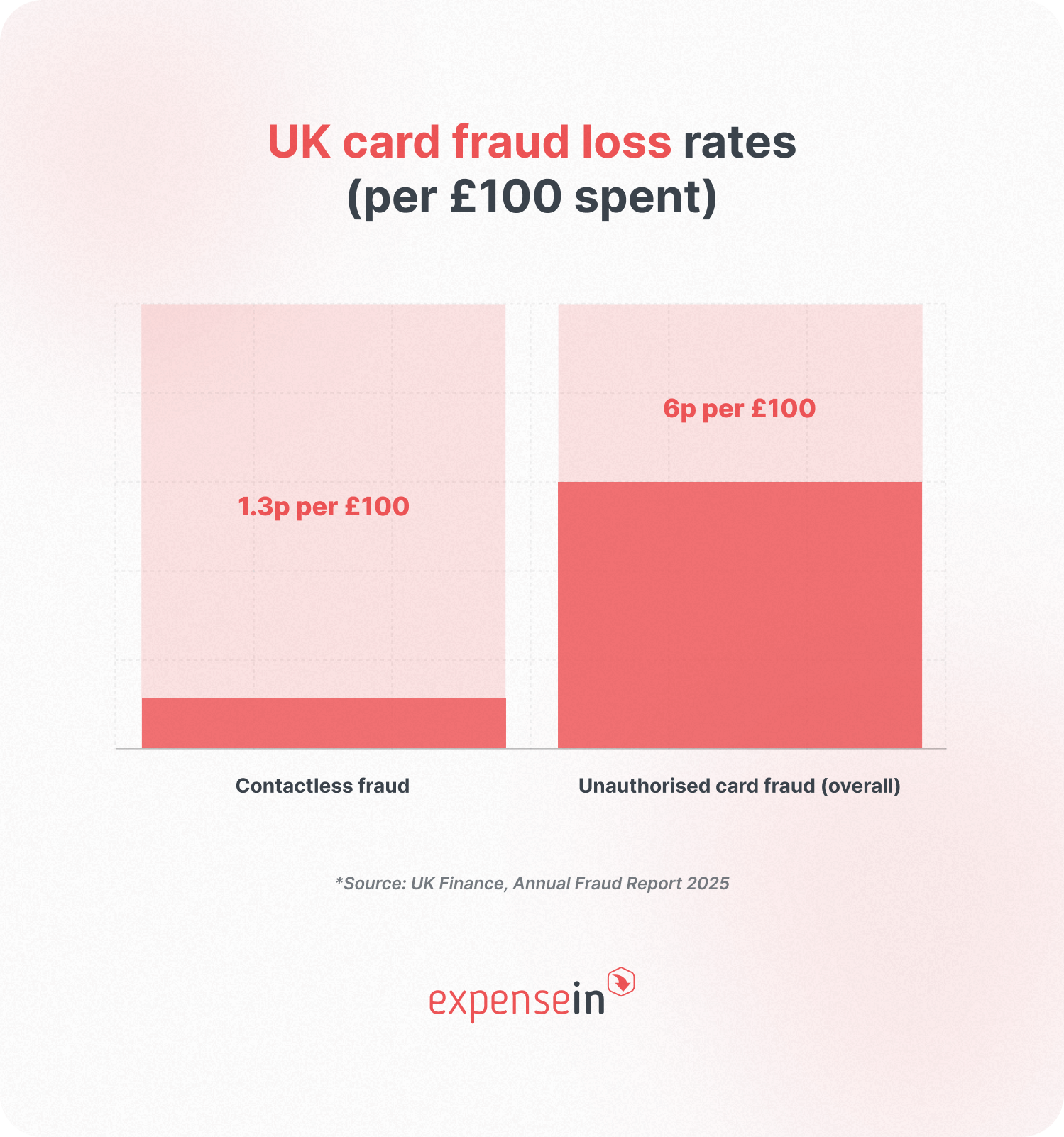

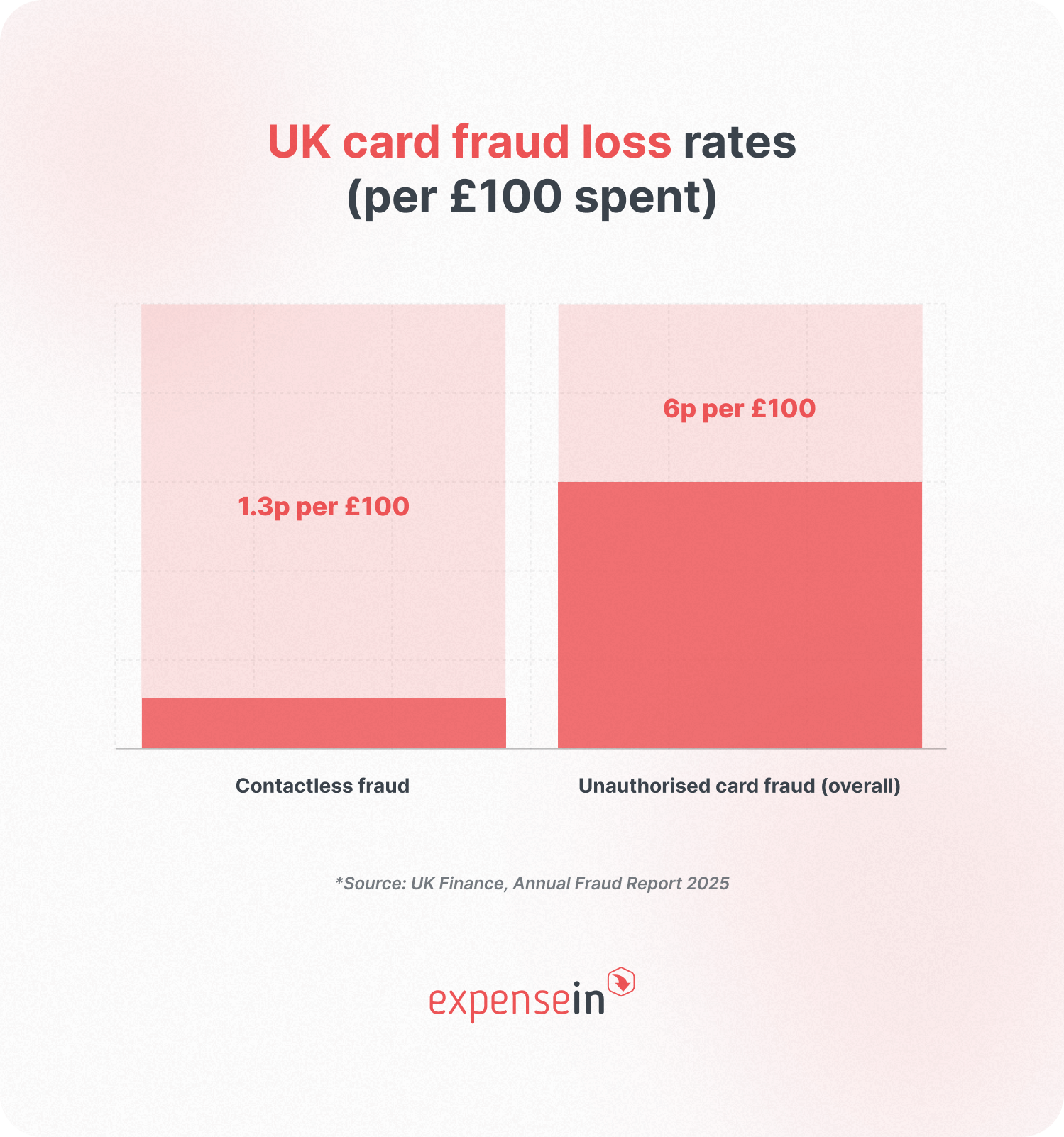

In most cases, yes. UK fraud data shows contactless fraud rates are low (around 1.3p per £100 spent) compared with about 6p per £100 for unauthorised card fraud overall.

Payment tokenisation: Why card details stay protected

When a company card is added to a digital wallet (for example, Apple Pay or Google Pay), the actual card number isn’t stored on the device or shared during a transaction.

Instead, the wallet generates a device-specific token that stands in for the real card details at the point of payment.

Merchants never receive the real card number,

Intercepted transaction data can’t be reused elsewhere, and

A breach at a merchant is far less likely to expose usable card details.

This is especially relevant because fraud risk is heavily skewed towards remote channels. In Ireland, online payments accounted for 77.4% of total fraudulent value in 2024 (€124m), and for card payments specifically, over 86% of fraudulent value was initiated online.

Device authentication: Why a phone can be safer than a card

A physical business expense card doesn’t verify who is using it. If it’s lost or picked up by someone else, it can often be used immediately.

With mobile wallets like Apple Pay and Google Pay, every payment requires user authentication, such as Face ID, fingerprint, or a passcode. If a phone goes missing, it can be locked or wiped remotely, cutting off access straight away.

The real risk isn’t the tap; it’s how cards are issued, added to wallets, and governed.

The Problem Isn’t Tap-To-Pay – It’s Uncontrolled Spend

Digital wallets don’t create chaos. Lack of control does.

Tap-to-pay simply makes spending quicker. If finance teams start seeing issues, it’s usually because wallet payments aren’t plugged into the same rules and workflows as other company spend.

What happens when wallet spend sits outside controls

These are the common pain points finance teams raise, and what’s actually behind them:

Missing receipts: Spend happens faster than receipts are captured

Unclear merchant names: Transaction data isn’t being clarified at the source

Out-of-policy purchases: Limits and category rules aren’t enforced at the point of spend

No real-time visibility: Finance only sees issues after the money is gone

Month-end surprises: Approvals and receipts are handled too late

The fix: Controls that apply no matter how someone pays

Whether someone taps their phone, uses a virtual card online, or swipes a physical card, finance should be working with the same guardrails.

That means:

Expense cards with built-in controls: Clear spending limits, day-based usage rules, merchant and category restrictions, and rules by role or team, so out-of-policy spend is blocked or flagged immediately.

Automatic expense policy enforcement: Transactions are checked against policy as they happen, not manually reviewed weeks later.

Real-time alerts and approvals: Managers and finance see spend when it occurs, while the context is still clear.

With these controls in place, digital wallets give employees speed and convenience, while finance teams retain visibility, consistency, and control.

How ExpenseIn Keeps Digital Wallet Spend Finance-Ready

For ExpenseIn, digital wallets aren’t an add-on. They’re a natural extension of controlled, real-time spend management.

ExpenseIn Cards are designed to work seamlessly with Apple Pay and Google Pay, so wallet payments follow the same rules as every other type of company spend.

Finance teams can:

Finance teams can:

Set spending limits by employee, team, or timeframe

Restrict merchant and spend categories

Apply additional controls for specific roles or projects

Freeze or disable cards instantly when needed

If a wallet payment is outside policy, it’s flagged or declined immediately – not dealt with later during reconciliation.

Each wallet payment:

is captured instantly with merchant, amount, and date;

triggers an immediate notification to the cardholder;

creates a draft expense automatically;

prompts receipt submission at the time of spend;

enters approvals and policy checks straight away.

Employees can pay by phone or smartwatch using a physical or virtual expense card, while finance retains full visibility and control.

How Digital Wallets Will Evolve in 2026

1. Tap-to-pay expands into higher-value spending

2026 is likely to bring more high-value contactless behaviour.

UK regulators have moved to remove the £100 contactless limit from 19 March 2026, allowing providers to set their own caps (phone wallets already support higher-value contactless in many cases).

That doesn’t make wallets riskier. It raises the bar for governance.

When “tap” becomes viable for bigger purchases, finance needs guardrails that work at the point of spend: limits, category rules, and approvals where needed.

2. Tokenisation becomes standard payment infrastructure

Wallet security will keep getting stronger because tokenisation is no longer niche; it’s becoming the default way modern payments are secured.

Visa has reported more than 10 billion network tokens issued worldwide via Visa Token Service.

3. AI supports real-time fraud and exception handling

As digital wallets become the default way people pay in person, decisions about risk and exceptions increasingly have to happen in real time.

This is already happening across UK financial services. The Bank of England and FCA’s 2024 survey shows widespread use of AI for fraud detection and financial crime controls.

For finance teams, the practical impact is clear: by 2026, more everyday wallet spend can flow with minimal friction, while genuinely unusual transactions are flagged earlier.

What This Means for Digital Wallets in Business

Digital wallets aren’t the problem. Lack of control is.

Mobile wallets are already how employees pay. What’s changing is how often they’re used and how quickly money moves.

When wallet payments sit under the same controls as the rest of the company's spend, the picture looks very different. Employees get faster, simpler ways to pay. Finance gets real-time visibility and fewer reimbursements.

So, the question isn’t whether digital wallets belong in business spending. It’s whether they’re set up in a way that finance can actually manage.

If you want to see how ExpenseIn can help you roll out digital wallets with control and confidence across your business, book a demo today.